The venture capital world has been through some significant changes over the past three years. Terms like “spray and pray” are out. Eye-watering valuations have dried up. And funding ever increasing cash burn without a path to “profitability” is a thing of the past.

Many would say some overdue rationality has finally returned to the market…

But what are the unintended consequences of this re-set? Like many financial cycles of the past, has there been an over-correction?

In my view – Yes!

The emergence of the word “profitability” in the start-up vocabulary is a good thing. But it has been driven in large part by VC’s. The push has come from VCs for founders to focus on profitability rather than growth at all costs. Many founders have blindly followed the messaging of VC partners without really thinking it through – is this the right path for my business? Am I doing this just to close the next funding round? And many VCs with little or no operating experience have prescribed a “one solution fits all” approach to investing and pushed founders (both before and after investment) to achieve profit no matter what.

We have gone from a world where it’s “growth at all costs” to a world of “profitability at all costs”.

Perversely, this has left some founders and VCs in what we call the “SME Trap” – a twilight zone where neither is happening – growth has fizzled out, yet profitable returns are not being achieved.

In this paper I will expand on how this has come about and highlight some ways to avoid the SME Trap.

Company X

Before getting into the details, I wanted to share the story of a Velocity portfolio company that has found itself in the SME trap.

We invested in the seed round of this company in 2021, for all the usual reasons: solving a massive problem, passionate and experienced co-founding team, compelling unit economics and some exciting initial sales growth. All the makings were there for great business and founder/VC partnership.

The company did extremely well in the post COVID years. Triple digit annual sales growth is expanding across the region. Burn was high, but all was going to plan.

They put together a Series A funding round in late 2023 and began pounding the pavement. We were keen to follow on, but as is our usual playbook, we were not able to lead and were looking to validate valuations through a new lead investor.

After spending a good part of the first half of 2024 knocking on the doors of hundreds of VC’s with strong introductions from our team and an excellent story, the founders were unable to secure a lead investor. The messaging was almost the same from every VC they visited: “you’re not profitable, and we don’t see a clear pathway towards this”.

Of course, it was incredibly disheartening for the founders. They had worked extremely hard to build a great company and were seeing strong market validation, but they could not attract the capital needed to continue the growth story.

Clearly a Plan B was needed. So, the founders cobbled together a small bridge round and began cutting costs. They trimmed headcount by 35%, scaled back international expansion plans and postponed product development rollout. There was a real focus on internal efficiency and in late 2024 the company had its first EBITDA positive month – just as the VC’s had asked.

Awesome!

Having achieved this important milestone, the board asked, “well – what’s next?”

Having been turned away from so many VC’s during the Series A pitch, the founders felt a further capital raise could not be achieved at valuations that made sense to them and some investors on their cap table, that the current growth rates were reasonable (15% per annum) and that after 6 years slogging it out – the best thing to do was continue the consolidation journey.

As investors – we are left in a minority position in a low growth start up with little prospects of achieving a viable exit. And the founders are left with their dream of building wealth and a global business unachieved.

The SME Trap.

Change in the VC landscape

The VC landscape has changed dramatically since the peaks of the early 2020’s where spray and pray, frothy valuations and massive cash burn were the norm.

But what were the underlying factors that caused such exuberance?

Here is our take:

- Low interest rates drove investors to alternatives, filling the coffers of VC’s, some with little or no experience and questionable mandates;

- This massive horde of VC dry powder flooded an already crowded market;

- Companies that were not innovating and had no prospect of scale were getting funded; and

- Founders that did not have the skills and character to build a company were getting funded.

All in all – a bubble.

Then, in 2022, post-covid inflation needed to be delt with. USD interest rates started increasing from low single digits to nearly 5% on risk-free lending – providing a very viable alternative to VC investing. But still the VC’s kept deploying….

As is often the case – a market correction was well overdue, but no one wanted to pay attention…and then, in early 2023, Silicon Valley Bank collapsed; and the music stopped.

VCs finally rejigged their deployment strategies: preserving capital to support existing portfolio companies and adopting the “profit at all costs” investment approach. Deal making slowed dramatically – in both count and dollar-value.

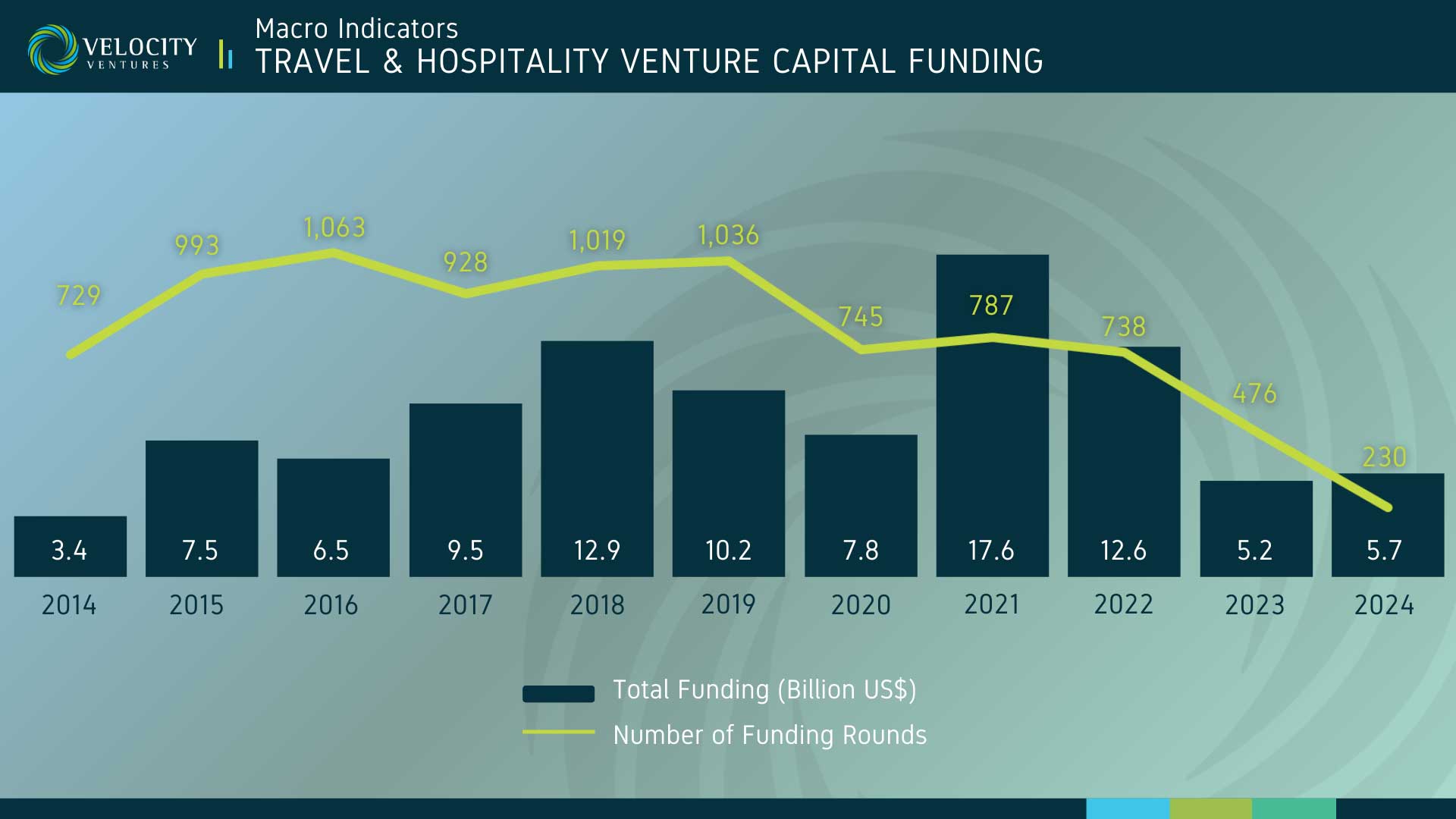

The numbers tell the story.

This investing reset has caused countless companies and VCs to follow the example of Company X – hunker down, reduce investment, cut costs and focus on that goal of positive EBITDA…but in the process, they end up in the SME Trap.

Avoiding the SME Trap

So – as founders and investors, how do we avoid the SME Trap?

Firstly – there is an assumption underlying this question – and that is: “The SME Trap is something to be avoided”. Let me first address this.

Alignment is one of the most important factors in business – in fact – in life. Whether it is employee and employer, customer and supplier or investor and founder – if there is not alignment of objectives, results will be sub-optimal and disputes will arise. This is well proven.

As VCs, we back founders with a vision to build a business at scale and are looking for founders with all the hard skills – but also passion and ambition. A burning drive to build a massive business and to exit.

The VC Trap is bad news for VC’s and leads to misalignment. All the factors that drive returns for VC’s are gone – growth, scale, path to exit and often, the ambition of the founder, after they see their growth plans in tatters. Building a growing business is much more fun than managing costs. This in turn becomes a problem for founders as they seek to juggle increasing misalignment with their investor group.

So, how do founders and VC’s avoid the SME Trap?

Make the right bets in the first place: Much of the blame lies at the feet of the VC industry. Many businesses and founders were backed that should not have been, creating a plethora of companies in the SME Trap. The industry needs to be more disciplined in allocating capital and remember the fundamentals of what makes a VC investible company – solving big problems, great founders, growth, solid unit economics and exits. Founders also need to recognize that not all startups are suitable for VC funding. Basic stuff that was forgotten in the boom.

Blindly following VC advise to go for early EBITDA positive: Clearly, in all businesses, there needs to be an achievable pathway to profitability. But there are some where long-term investments really deliver massive value. For example, network effect businesses need to reach escape velocity, and once they do, barriers to entry kick in and huge value is created. Cutting costs and slowing growth won’t work in such businesses – another founder with more funding will displace you. On the other hand, it may make perfect sense to go for early EBITDA positive in niche businesses which can remain protected and grow steadily. But such a strategy requires thinking beyond the magical moment of cash positive: What does it mean for all stakeholders, and do they buy into a low growth, no exit game plan?

Taking down rounds: The exuberance of the early 2020’s has left many cap tables in an un-fundable state, populated with inexperienced investors who entered at high valuations and not wanting to budge; or investors clinging to liquidation preferences. Stacks of convertible notes and investor lists approaching 100 in number are not uncommon. Public markets would have written the valuation of underperforming companies down, and haircuts would be taken. But private markets are different – they take much longer for adjustments to flow through. In a business where value accretive growth can be achieved, it’s generally better to take a hit on the MOIC and get back on the growth train. Remember: (VC’s) you can’t distribute MOIC to investors and (founders) it won’t fund your nest egg.

M&A: The boom years of the cycle saw an oversupply of capital and the creation of an intensely competitive tech landscape in most markets. It’s not uncommon to see half a dozen SaaS competitors going hammer and tongs after the same customers with virtually the same product. This has generated a proliferation of sub-scale businesses that face massive competitive pressures and who can’t generate cost effective organic growth. In such circumstances, M&A may be a good option. It generates scale, reduces competition and creates winners which can once again attract funding or buyers. Of course, history is littered with stories of failed mergers – it’s not easy to find off ramps for surplus founders and convince inflexible investors it’s in their interest to dilute – but the risks of a failed merger need to be weighed against the option of falling into the SME Trap and having no way out.

Motivating founders: Founder motivation often suffers in the SME Trap – and can in fact be a cause. What started out as an exciting journey becomes a slog: competing investor interests, staff layoffs and tight cashflow management. Some founders lose their drive and are happy to sit it out, take salaries and forgo growth – especially those with messy cap tables. Others may find themselves diluted though down-rounds and working 24/7 just to keep their VC in the money – which makes no sense. In such circumstances, a re-work of the cap table is needed. A fresh and generous ESOP allocation can do the trick, or even a change of founding/leadership team can give better outcomes for all involved.

Alternative funding sources: VC funding is not for everyone – not every business suits it – especially when faced with the SME Trap. In such circumstances its worth considering other forms of funding – family and friends, strategic corporate money or debt (bank or venture). These funding sources can often help to bridge out of a situation and set up an M&A or Secondary.

Secondaries: With alignment at the heart of the SME Trap, it may be better for a VC to take a MOIC hit and sell their interest to an investor with patient capital – either family and friends or perhaps strategic. These investors do not have the pressure of driving exits as fund lives come to an end. Additionally, such transactions can remove a stress point in the founder/VC relationship allowing focus on the business rather than investor management.

It is a long list! But the problem is real, and a large number of startups and VCs are finding themselves in the SME Trap. Hope is not a strategy and taking concrete action to break out of the SME Trap is important, before misalignment causes investor frustration and founder fatigue. The good news is: There are options! Facing realities and taking action is what business is all about, so founders and VC’s – time to get to work!