It’s time for tourism businesses to shift investment and financing towards decarbonising our planet’s future.

During COP27 held in Egypt last month, the United Nations World Tourism Organisation (UNWTO) urged the tourism industry to take urgent action to reach net zero, and discussed the pathways to achieve measurement and decarbonization, as well as regeneration and finance.

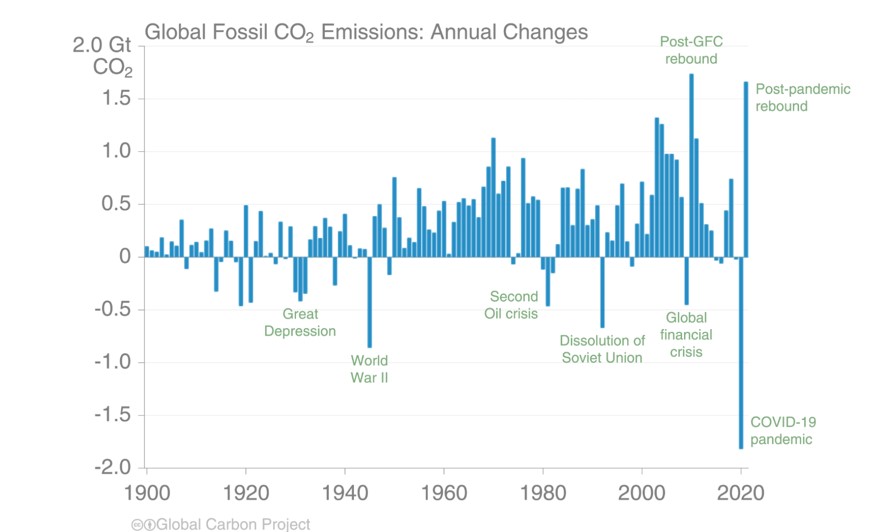

According to the latest “United in Science” report, CO2 emissions are on the rise with atmospheric greenhouse gas (GHG) concentrations reaching record levels driving rapid climate change which in turn threatens our way of life on earth.

The latest data compiled by the World Meteorological Organisation (WMO) under the direction of the United Nations Secretary-General indicates that to get back on track to limit global warming to 1.5°C, there is an urgent need to for every individual and corporate to take action or face a possible climate catastrophe.

Atmospheric greenhouse gas (GHG) concentrations continue to rise and fossil fuel emissions are now above pre-pandemic levels after a temporary drop due to lockdowns associated with the COVID-19 pandemic in 2020 and 2021.

United in Science provides an overview of the most recent science related to climate change, impacts and responses from the World Meteorological Organization (WMO) and partner organizations.

Here in Asia, climate change has already demonstrated detrimental impacts on livelihoods with economic losses arising from drought, floods and landslides. According to a new report from the World Meteorological Organization (WMO), over 100 natural hazard events in Asia took place in 2021 and caused total damage of US$ 35.6 billion, affecting nearly 50 million people.

Nobody can afford to be complacent as climate change intensifies and takes a toll on socio-economic development.

Travel & Tourism Value Chain

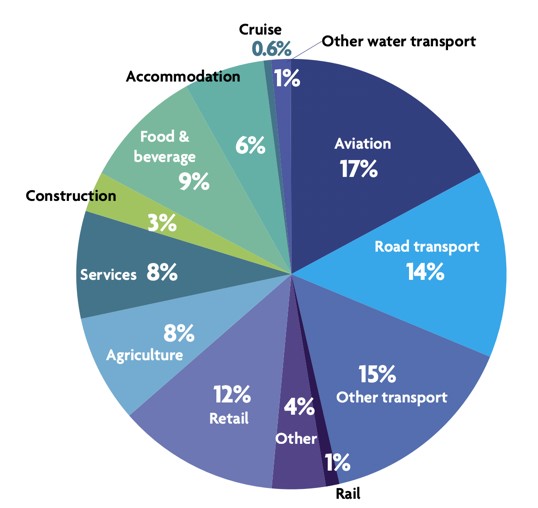

World Travel & Tourism Council (WTTC) in collaboration with the UN Environment Programme (UNEP) and Accenture published a Net Zero Roadmap for Travel & Tourism in November 2021. The report aggregated data and reporting insights available on carbon emissions for aviation, accommodation, and cruise, creating a chart showing the split of pre-pandemic carbon emissions generated by different industries in the Travel & Tourism value chain.

Split of tourism-related Greenhouse gas emissions by industry (pre-pandemic)

Since the launch of Glasgow Declaration on Climate Action in Tourism at COP26 in 2021, over 700 businesses and destinations have pledged to decarbonise by 2050. The implementation of collective action to achieve net-zero across tourism stakeholders is led by UNWTO in collaboration with the Travel Foundation.

Key actions recommended fall under seven categories.

– Sustainable aviation fuel

– Electrification and efficiency

– Infrastructure improvements

– Taxes and subsidies

– Offsetting

– Travel behaviour

The Challenge of Decarbonisation

Common challenges across our industry to reach our net zero targets range from accurate emission measurement and reporting to a fragmented regulatory landscape, insufficient budgets or hard to replace infrastructure.

There are “hard to abate” subsectors where costs for transformation can be prohibitive, resulting in a long-transition to net zero. Such is the case for asset-heavy sectors in the travel and tourism industry: aviation, cruise or hotels where it will take time to implement infrastructure improvements, or switch to hydrogen or electric powered solutions to reduce absolute carbon emissions.

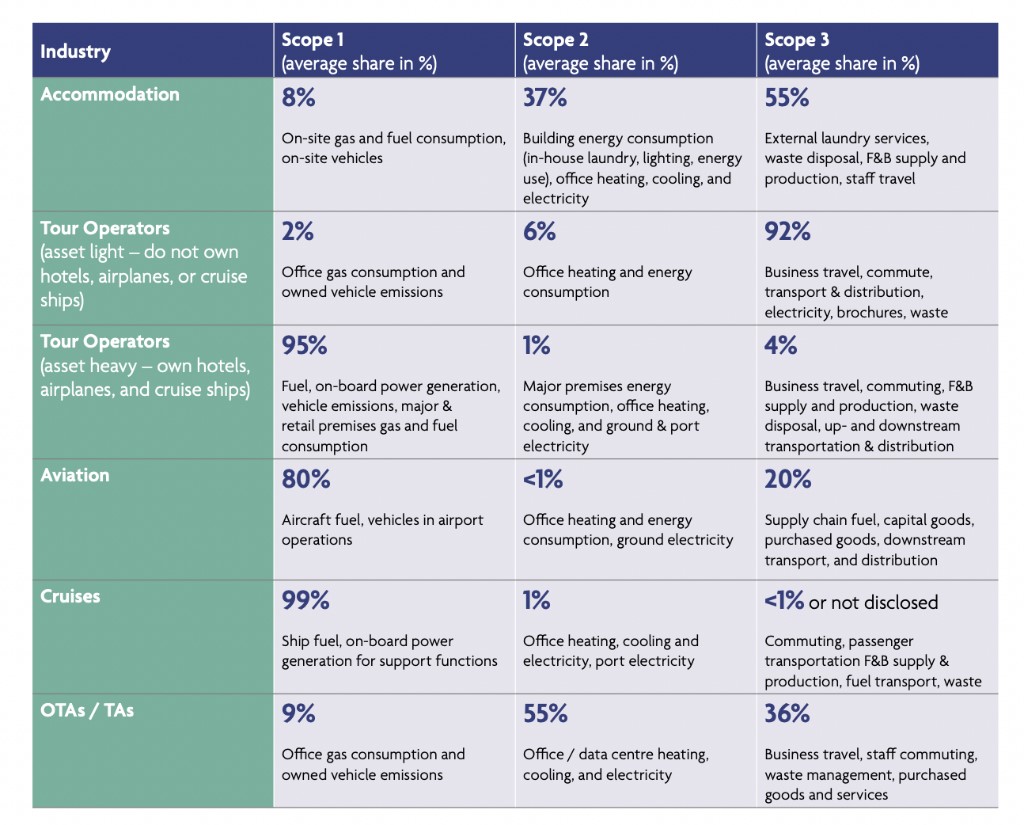

Overview of reported Scope 1, 2 and 3 emission profiles of the Travel & Tourism industries

As a reminder, Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company. Scope 3 includes all other indirect emissions that occur in a company’s value chain.

With Accommodation, OTAs and Asset Light Tour Operators contributing to Scope 2 and 3 carbon emissions, an immediate way for such companies to reduce their carbon footprint is by reducing their carbon emitting inputs like switching to more energy efficient appliances and lightings, and reducing staff travel. Conversely, for the Aviation sector, Asset Heavy Tour Operators and Cruise Lines, which are largely Scope 1 emitters and having direct control of their emissions, it would be important to set a roadmap to replace infrastructure over time.

For example, hoteliers can invest in technology and transform their properties to be less reliant on fossil fuels. Contributing to regenerative projects that protect forests and coastal ecosystems can also help companies reduce their carbon footprint in the short term.

From 2027, all international flights will be subject to mandatory offsetting requirements. This represents over 90% of all international aviation activity. Ahead of this requirement, the aviation industry has adopted a voluntary programme since 2021 – CORSIA, or Carbon Offsetting and Reduction Scheme for International Aviation. It is the first global market-based solution that airlines can use as a major step to reach net zero emissions by 2050. CORSIA seeks to neutralize international aviation CO2 emissions via carbon offset programmes and will run until 2035. Monitoring, reporting and verification (MRV) helps ensure the integrity of carbon offsets under CORSIA

Travel and Hospitality Climate Finance

As global leaders shift their attention to climate finance, COP27 saw US$4 to $6 trillion a year committed for investments in technology and infrastructure. Therein lies an opportunity to simultaneously tackle climate change and drive digitalisation in South-east Asia where four out of 11 unicorns come from Travel & Hospitality.

Concurrently, consumer sentiments are changing – often ahead of regulatory changes. Travellers are becoming more conscious of their environmental footprint and are looking for more sustainable travel options.

These factors together mean industries should take the lead, and act ahead of government policy.

How to price carbon – Carbon Tax or Cap-and-Trade or a blend of both?

A pragmatic approach is to combine voluntary high-quality carbon offsets with investments in long-term and systemic change, plus taking an active role to help consumers shift to more sustainable habits.

Mr Ravi Menon, Managing Director, Monetary Authority of Singapore recommends that putting a meaningful price for carbon is the single most important measure to help decarbonise the economy.

“Without getting the price of carbon right, most sustainability efforts will not make economic sense and not gain traction. The right price on carbon sends a powerful signal across the entire economy: it induces consumers to reduce demand for carbon-intensive goods and services; firms to move to low carbon technologies; innovators to invent and develop new low carbon products and processes; and investors to fund and commercialise them.

“The invisible hand of the carbon price incentivises and coordinates emissions-reduction efforts in ways that regulation cannot achieve.”

While carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions a cap-and-trade regime sets the quantity of emissions reductions, allowing the market to adjust the price of carbon.

Relying solely on a carbon tax approach may not drive the fastest reduction in carbon emissions. While a carbon tax is a good way to cost the negative externality and for businesses to have certainty in what their costs are, it is not possible to know in advance what specific benefits the tax revenues will generate as the proceeds go to a government’s consolidated revenue, and governments themselves are high GHG emitters.

With a cap-and-trade system, proceeds can be diverted to meaningful high-quality carbon reduction projects which allows more flexibility on driving market-led adjustments, especially when reducing emissions is even more crucial now. By allowing companies the option to buy or sell an allowance, this model allows the market to set the price for carbon, and incentivises emissions reduction in the most cost-effective way.

Both cap-and-trade with a ceiling price and carbon taxes have their strengths. However, in our view, a clear signal to the market via carbon tax with ability for emitters to either pay the tax or purchase off-sets is the best combination of pricing the externality but still allowing funds to flow to projects that are delivering abatement for less per MT than the tax..

What is the right price of carbon?

The right price of carbon should be the social cost it imposes on the environment and allowing the market to set price adjustments that would be more aligned to the global targets of pricing.

International bodies like the International Monetary Fund (IMF) and Organisation for Economic Co-operation and Development (OECD) warn that carbon prices are generally too low to seriously drive adoption of low carbon alternative. Currently, the global average carbon price is US$6 per tonne, but to achieve the goals of the Paris Agreement, the World Bank estimates pricing needs to be US$50-90 per tonne.

In Singapore, where Velocity Ventures is based, the current price level is US3.60 (S$5) per tonne, with the Singapore government stating plans to slowly increase carbon taxes to approximately US$36-58 per tonne by only 2030.

Other countries in Southeast Asia are likely to lag further behind Singapore, which is generally regarded as a progressive and fast-moving policy maker. Some technology projects to consider include AI tools to monitor energy consumption, OTAs that promote sustainable experiences, or platforms that can streamline sustainability certification schemes.

Pathways to Net Zero

“Achieving net zero by 2050 remains ambitious for tourism and more finance is needed. Investing in climate action in tourism is investing in green resilient and inclusive development” said Mari Pangestu, managing director, development policy and partnerships, World Bank Group.

To play our part and drive the future resilience of tourism, our fund invests in high growth startups, from Seed to Series A. We take a sector-strategic expertise approach and employ institutional financial discipline to seek out new projects for economic diversification and market-creation.

We hope to galvanise more organisations within our industry to invest in our future collectively, and place future considerations about how businesses can reduce greenhouse gas emissions and achieve carbon neutrality with investments in long-term and systemic change.

Velocity Ventures has recently invested in New Zealand enviro-tech company CarbonClick that offers corporates and consumers options to offset the carbon footprint associated with their travel. We are excited to support their growth in this part of the world as they offer high-quality carbon offset programmes by showing where and how their contributions have been used with a “track and trace” feature providing full details of the offset.

While voluntary offsets provide a proactive solution for corporates and consumers to stay ahead of slower moving industry schemes or government regulation, it is also important for tourism businesses to shift investment and financing towards decarbonising our planet’s future. This is now the most effective way we have of pricing the negative externality of Co2 emissions

Entrepreneurs will play a key role in achieving our industry’s transformation to net-zero, bringing to market the technologies that are needed to drive this change. Velocity Ventures is committed to supporting their ambitions, taking pro-active steps to invest and help grow their companies and the technologies that will allow us to achieve a low carbon world

To find out more about what other tourism organisations are doing to reach their net-zero goals, download our report here. If you are keen to get involved with Climate Finance in travel and hospitality, reach out to our team here.

To read more about the right and wrong ways to approach carbon offsetting, check out CarbonClick’s insightful report here.

Nicholas Cocks is managing partner and co-founder of Velocity Ventures, a Singapore-based venture capital firm with a unique focus on the Travel and Hospitality industry in South-east Asia. A successful entrepreneur turned investor, with 35 years of CEO & board-level leadership experience, Cocks is a huge advocate of sustainable investing.