In this paper, I will continue researching past-data on Venture Capital returns to determine thematic strategies for LPs looking to invest in early-stage companies. Previous papers have demonstrated that investing in earlier stage companies yielded better returns that later stage investments, that VC investments out-performed public equity markets just as public equity markets hit their peak, or shortly thereafter, and that sector-specific fund managers out-performed generalist funds more often than not.

This paper will again focus on Managers by investigating the widely held belief that “Established Managers” out-perform “Emerging Managers”. Spoiler Alert: they don’t!

Firstly, a definition: “Emerging Manager” is generally held to mean either a Manager who is managing 2 or less funds, is transitioning from managing their own investments to managing pooled investments, or has AUM under USD200m. The datasets referenced in this paper all use slightly different themes on these broad definitions.

Bias Against Emerging Managers

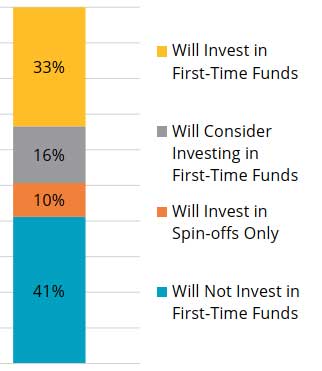

Unfortunately, despite what this paper will show, many investors avoid Emerging Managers. A survey conducted by Preqin Private Equity Online in 2017 found that only 33% of investors have a clear mandate to invest in Emerging Managers, while a whopping 41% will not even consider it.

The arguments against Emerging Managers are often based on generalized assumptions rather than data-driven insights. While it’s important to weigh the potential risks of investing in Emerging Managers, there is little evidence to support these widely-held biases with a considerable number of data-driven surveys that would draw the exact opposite conclusion.

Historical Performance of Emerging Managers

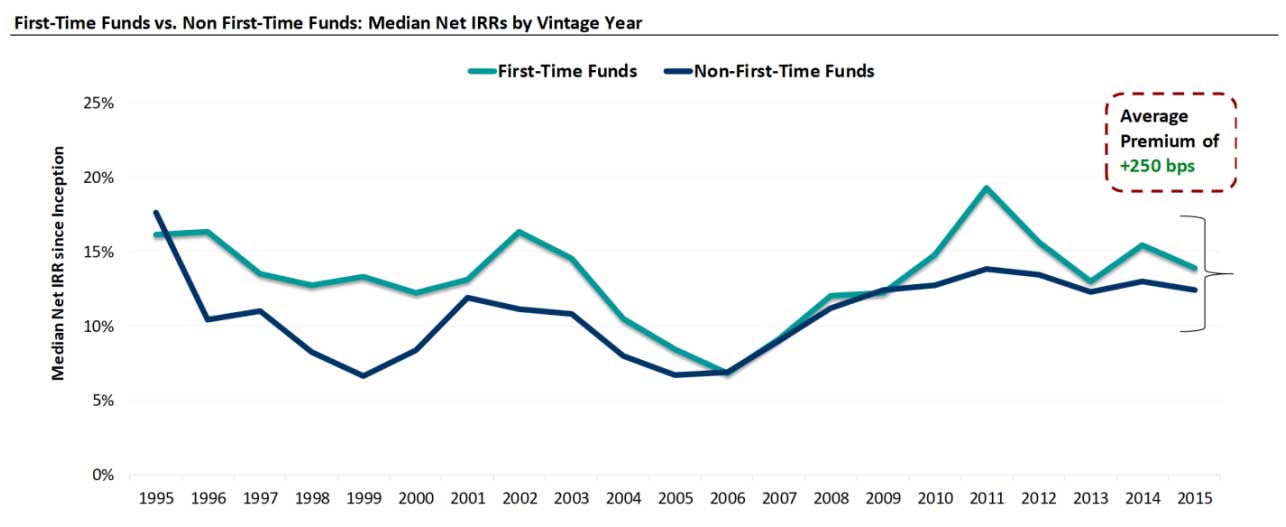

A study by Makena Capital Management in 2019 surveyed the results of over 1,100 private funds over a period of 20 years. When the results of the funds managed by Emerging Managers were compared to the established managers, the Emerging Managers achieved average returns of approximately +250 basis points.

A similar study by eVestment Emerging Managers Report on hedge fund results conducted in 2015 found that the younger portion of the funds analysed outperformed the older portion by +200 to +300 basis points. The same survey also found that the smaller AUM hedge funds outperformed the larger AUM funds by +150 to +250 basis points.

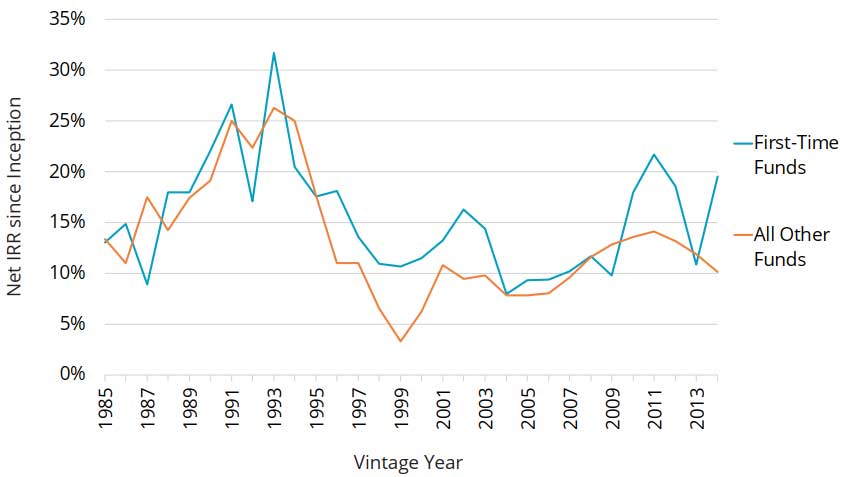

Another study, by Preqin Private Equity Online conducted in 2018 found that Emerging Managers outperformed all other funds in 22 out of the 28 vintages assessed.

The same study found that Emerging Managers achieved top quartile performance (when compared with all funds) 34% of the time – much more than than expected figure of 25% being in the top quartile.

The studies referenced above show that Emerging Managers tend to outperform their more established counterparts by significant margins.

Key Factors Contributing to Outperformance

There are several reasons why Emerging Managers regularly outperform;

- a) The entrepreneurial spirit and drive for excellence is highest early in any firm’s existence.

- b) A smaller fund size means that Emerging Managers can’t profit from management fees and instead derive their income from carried interest, alligning interests of LPs and managers.

- c) Being an early investor with an Emerging Manager can come with favorable terms, such as lower fees or access to co-investments.

- d) Emerging Managers are more open to collaboration with LPs as they build their firms and reputation, leading to enhanced strategies and greater opportunities.

- e) As shown in previous papers, sector specific managers generally out-perform their generalist peers and Emerging Managers are more likely to be sector specific as funds are often launched off the back of prior success in their sector of expertise.

The Case for Investing in Emerging Managers: Velocity Ventures

In summary, there is little evidence to support the widely held view that investing in Emerging Managers is riskier with considerable research done to demonstrate that the exact opposite is true.

Velocity Ventures is proud to brand ourselves as an Emerging Manager having successfully raised a first fund (now almost fully deployed). Velocity’s GPs have all the credentials of successful Emerging Managers highlighted above with entrepreneurial track records in travel and hospitality, early stage investing and banking.

Building on the success of Fund 1, we are now preparing to launch our second fund, further capitalizing on our deep expertise and momentum.