Industry Trend Watch

Monthly update on the impacts and opportunities of current events for the travel and hospitality industry

In partnership with Pear Anderson, one of the leading Southeast Asian tourism industry intelligence consultancy firms,

our newsletter aims to provide a greater overview on travel and hospitality trends around the region, and to provide industry stakeholders and travel tech entrepreneurs with insights that will help them address challenges to drive the recovery and growth of the travel and hospitality sector.

Covid-19 Impact Newsflash – 14 June 2022

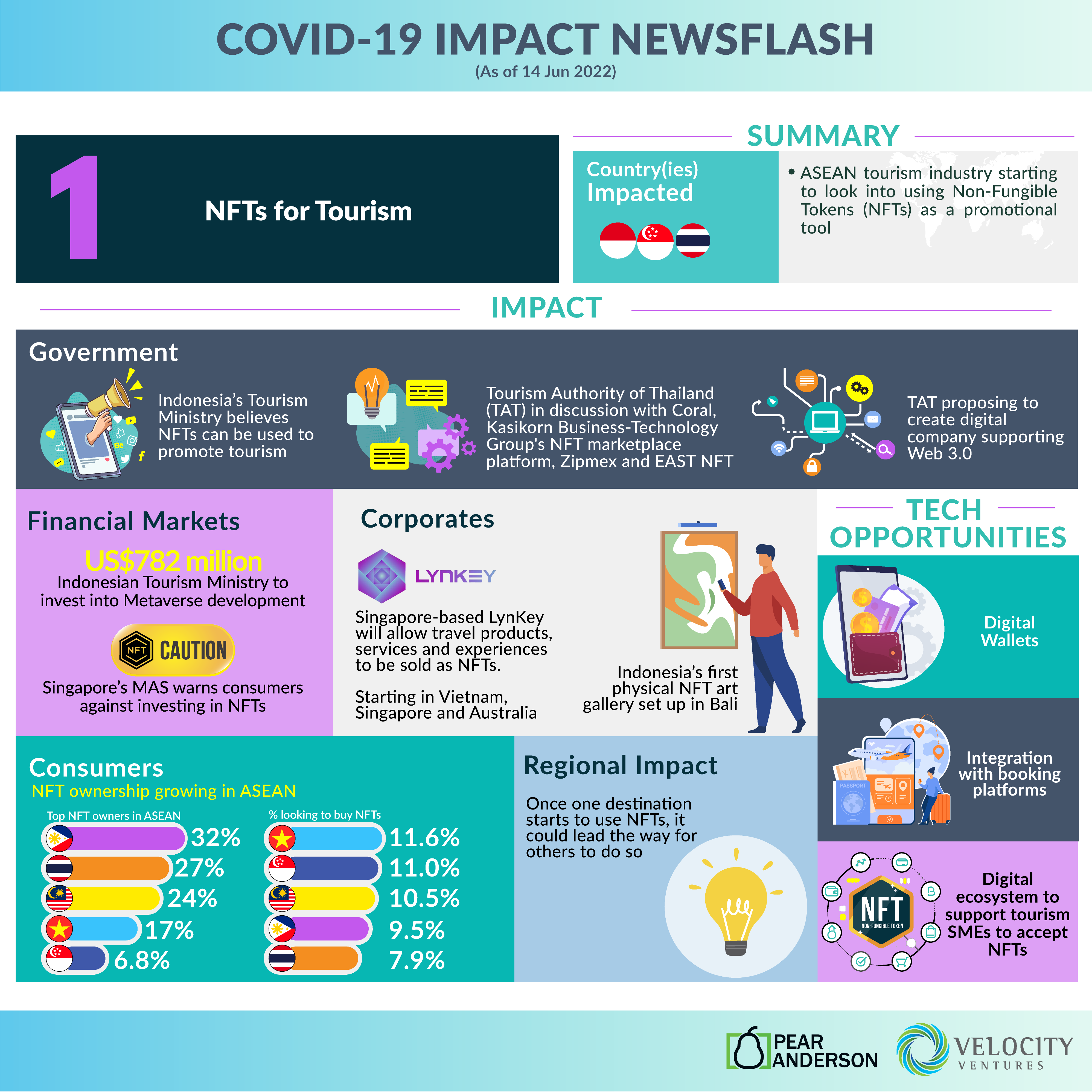

1. ASEAN tourism industry starting to look into using Non-Fungible Tokens (NFTs) as a promotional tool

As NFTs pick up speed in terms of public awareness, tourism ministries across Southeast Asia are starting to seriously consider how they could be used to stimulate the tourism economy, as well as boost awareness of a destination.

Our thoughts:

NFT ownership is on the rise in Southeast Asia. A survey has indicated that 32% of respondents in the Philippines are owners, as are 27% in Thailand and 24% in Malaysia. Tourism boards and ministries are becoming increasingly aware of NFTs and the potential that they could hold for stimulating a tourism recovery, and typically class them together in the same scope as cryptocurrencies and the Metaverse, other hot topics.

Whilst no tourism board has yet clarified exactly how they would intend to use NFTs, the private sector may be taking the lead, with the likes of LynKey, a Singapore-owned NFT marketplace, aiming to revolutionise smart tourism services.

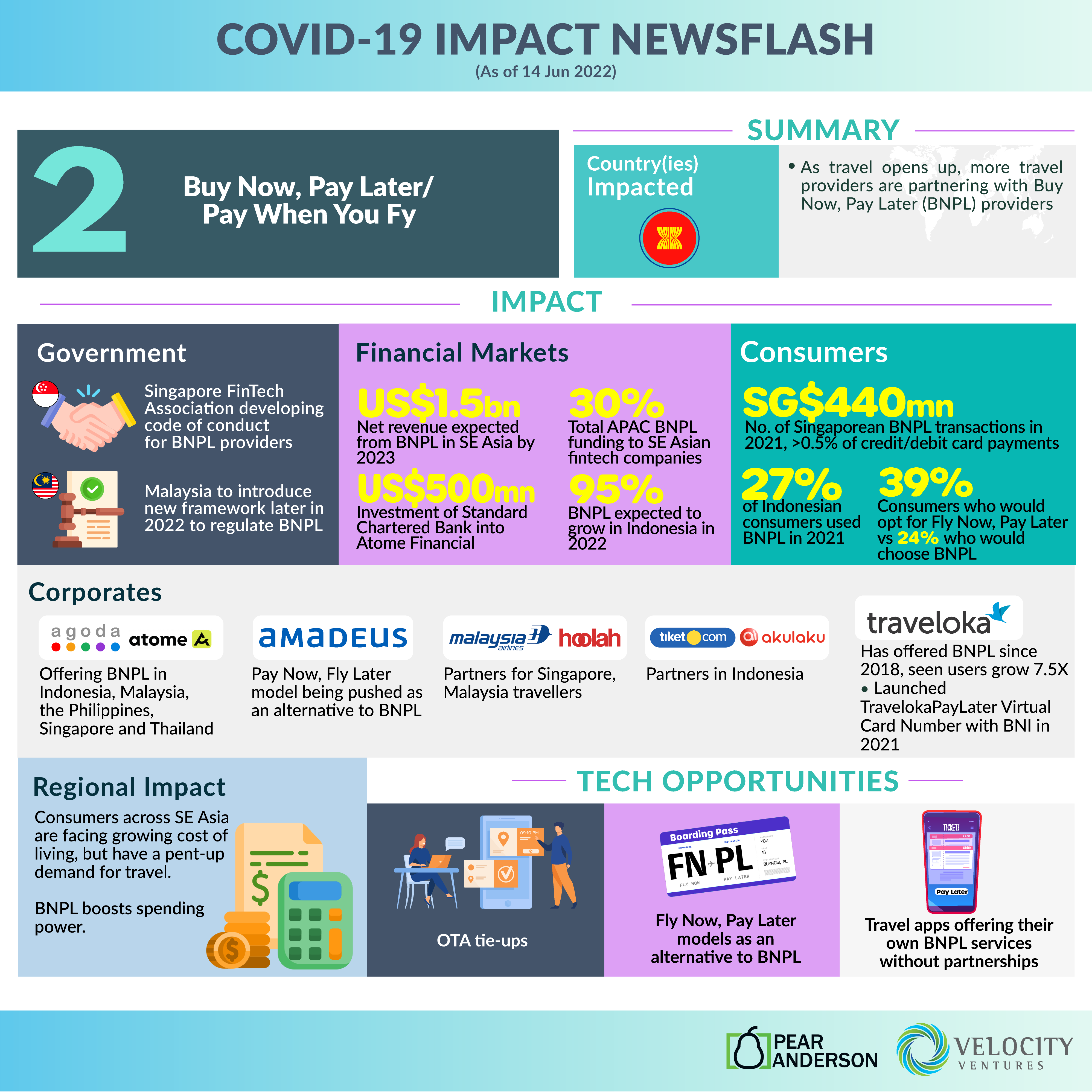

2. As travel opens up, more travel providers are partnering with Buy Now, Pay Later (BNPL) providers

Buy Now, Pay Later has been a popular option across Southeast Asia for the past few years for e-commerce. Now that travel is picking up and budgets are squeezed, BNPL is being introduced by OTAs and airlines.

Our thoughts:

Buy Now, Pay Later (BNPL) is far from a new concept in Southeast Asia, with many home-grown BNPL providers dominating the market. However, in much of the region (with the exception of Indonesia), BNPL has largely been applied to e-commerce, rather than travel products.

With travel restrictions easing yet the cost of living increasing, BNPL are starting to forge partnerships with airlines and OTAs to extend the concept to travel products, too.

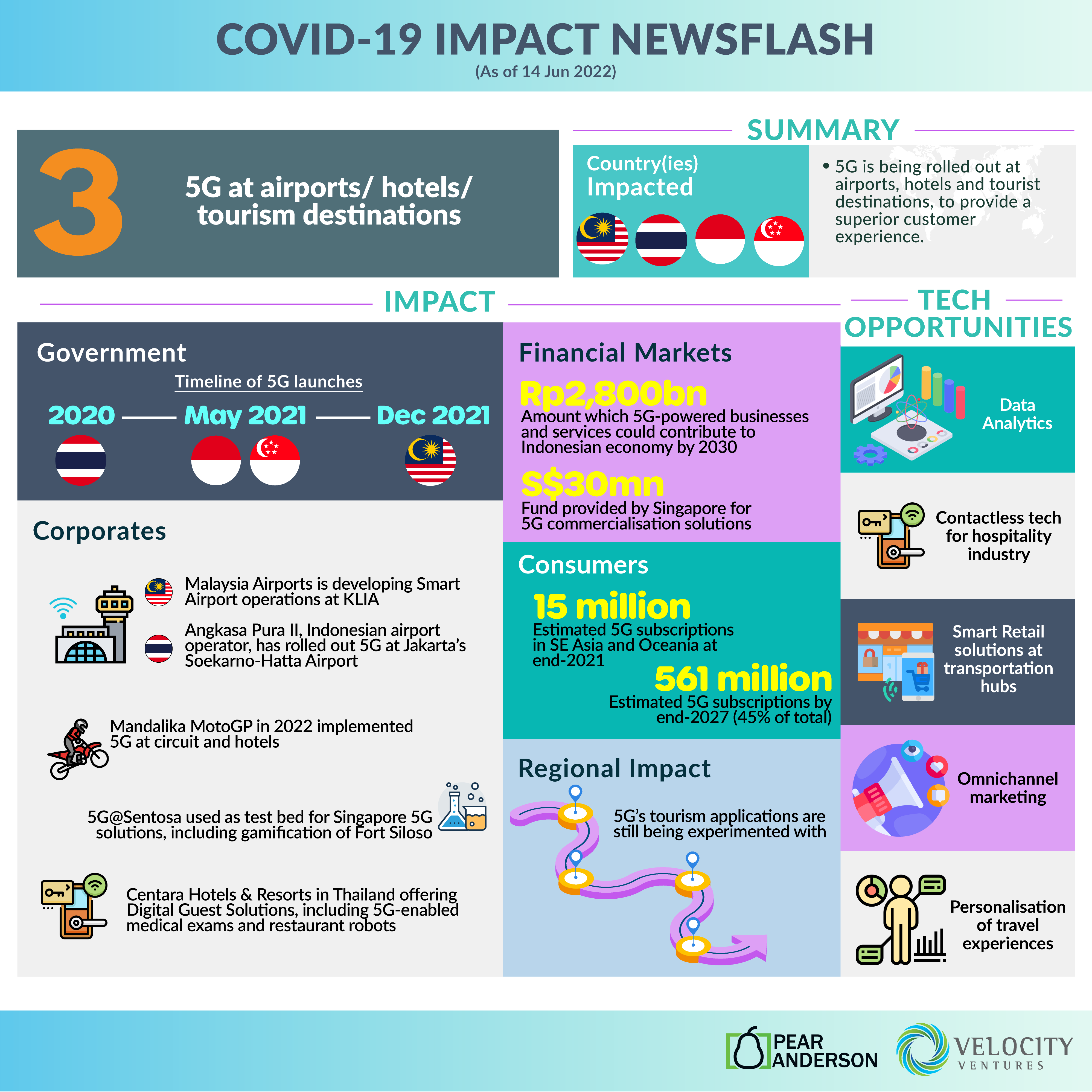

3. 5G is being rolled out at airports, hotels and tourist destinations, to provide a superior customer experience

Governments are starting to experiment with the benefits which 5G could bring to the tourism industry, from more personalised travel experiences, to smoother journeys through transportation hubs.

Our thoughts:

5G started to be rolled out commercially in Thailand from 2020, but it was from mid-2021 when more countries in Southeast Asia started to launch their own networks. Now, governments are looking at its usage in the travel industry, particularly for transport hubs such as airports.

Tourism businesses such as Centara Hotels & Resorts, are also implementing 5G, allowing for a greater personalisation of guests’ experiences.

Covid-19 Impact Newsflash – 12 May 2022

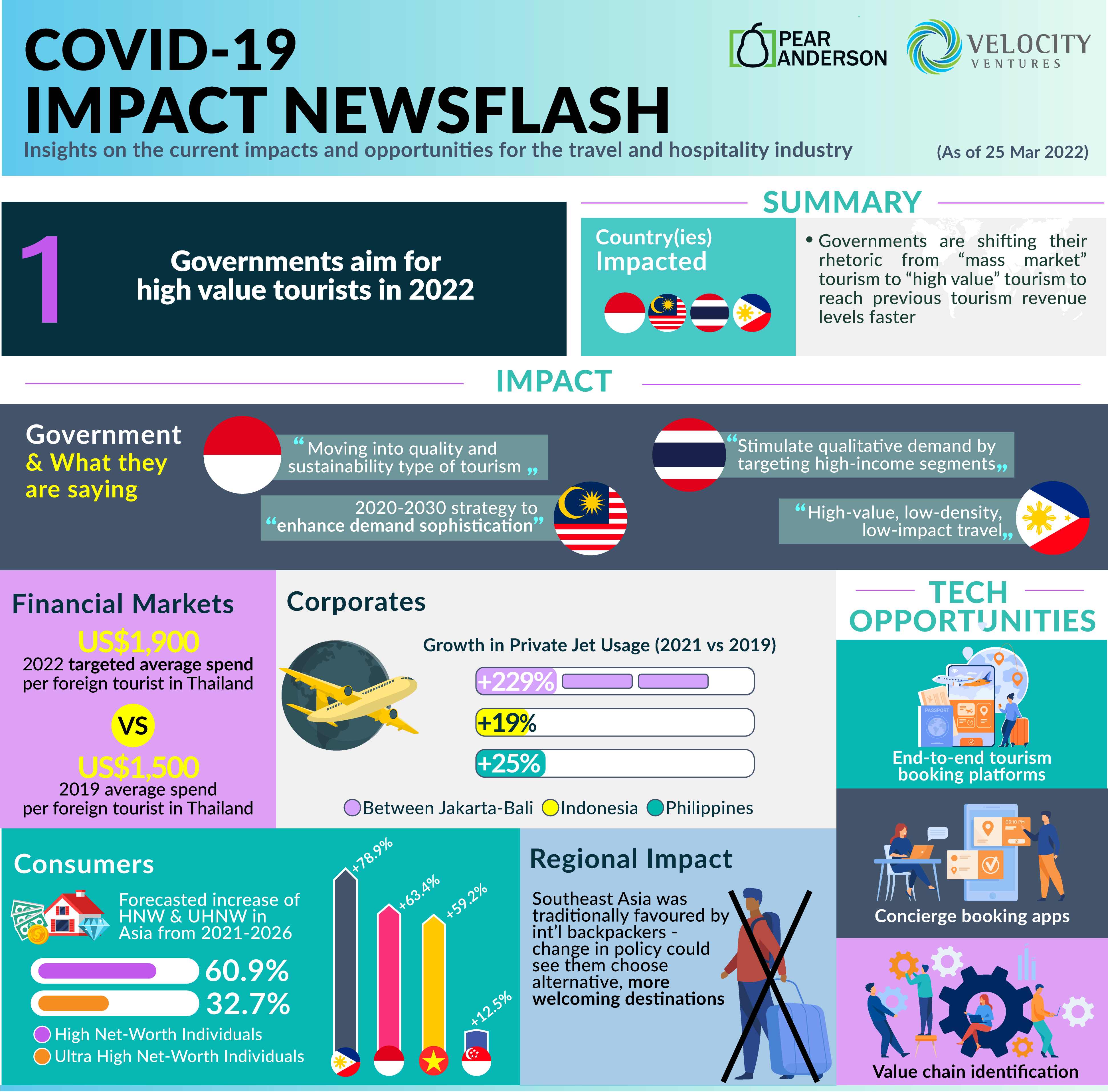

1. Governments aim for high value tourists in 2022

2. Southeast Asia opens up borders, despite record cases

Southeast Asia has done a complete 180 on its policies one year ago, when the majority of the region was pursuing a zero-COVID policy. Countries such as Vietnam reopened their international borders on the same day as reporting record cases – but with vaccinations and booster dose administration covering ever greater percentages of the population, governments seem to have accepted the need to reopen the borders – not only to support the tourism sector, but the economy at large, too.

3. Alternative model OTAs

Even prior to the pandemic, hotels and travel suppliers were starting to grow tired of the high commission levels which international Online Travel Agents (OTAs) were demanding. COVID-10 has made that awareness all too acute, when every cent counts, and new zero commission models have started to be tested in Thailand. These have clear benefits for the suppliers – but whether the new platforms will also win market share from customers is also a valid concern.

4. More destinations launching and investing in AR/ VR

Once seen as expensive and not necessary, AR and VR technologies are starting to be used by more destinations and attractions in the region as both an avenue for sales, e.g. charging customers for AR/ VR experiences, as well as enhancing a destination’s marketing tools. Whilst it has far from widespread adoption in Southeast Asia right now, we see the Philippines and Singapore starting to take the lead in practical implementation of these technologies.

Covid-19 Impact Newsflash – 25 March 2022

Southeast Asia opens up borders, despite record cases1. Governments aim for high value tourists in 2022

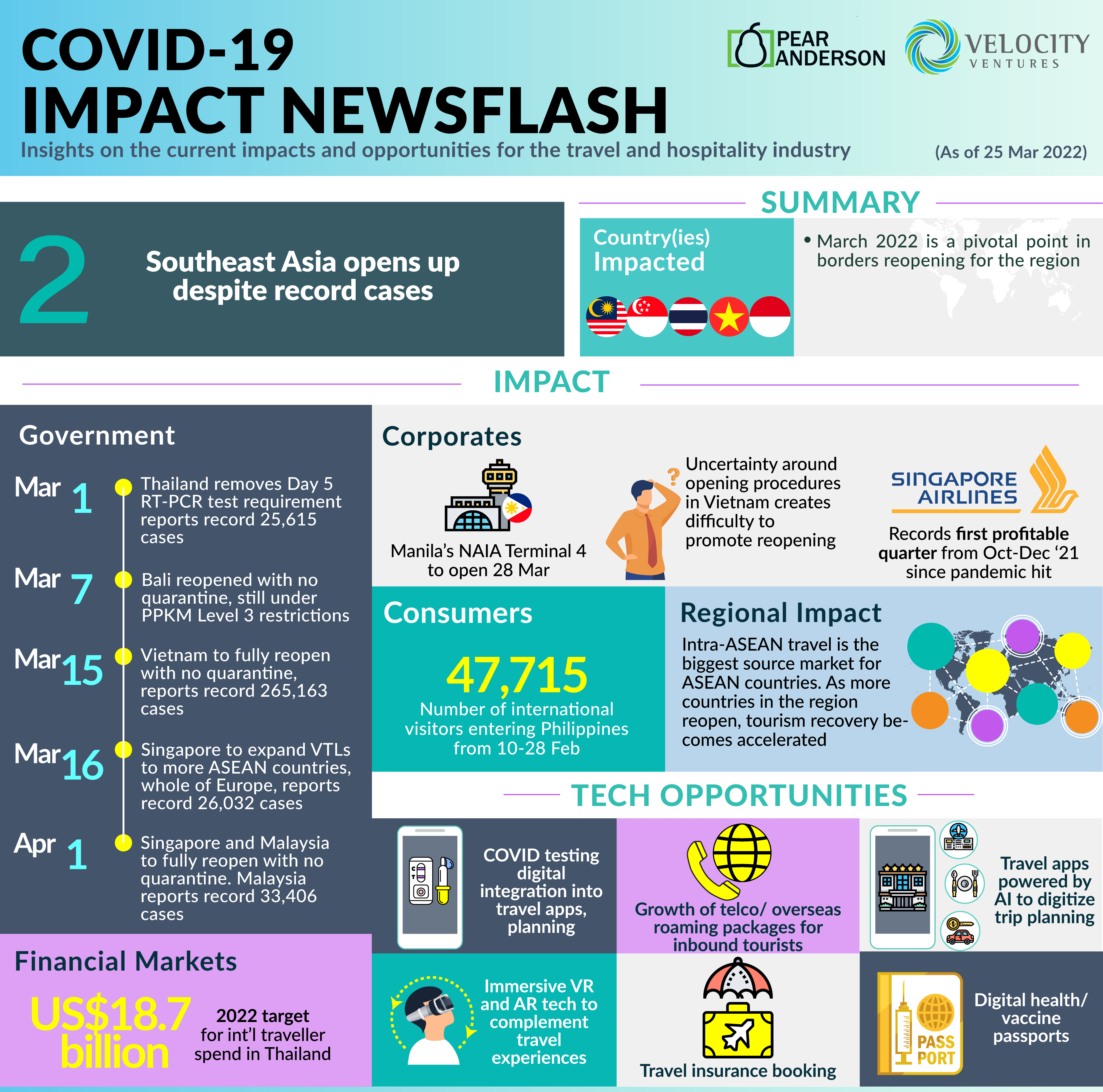

2. Southeast Asia opens up borders, despite record cases

Southeast Asia has done a complete 180 on its policies one year ago, when the majority of the region was pursuing a zero-COVID policy. Countries such as Vietnam reopened their international borders on the same day as reporting record cases – but with vaccinations and booster dose administration covering ever greater percentages of the population, governments seem to have accepted the need to reopen the borders – not only to support the tourism sector, but the economy at large, too.

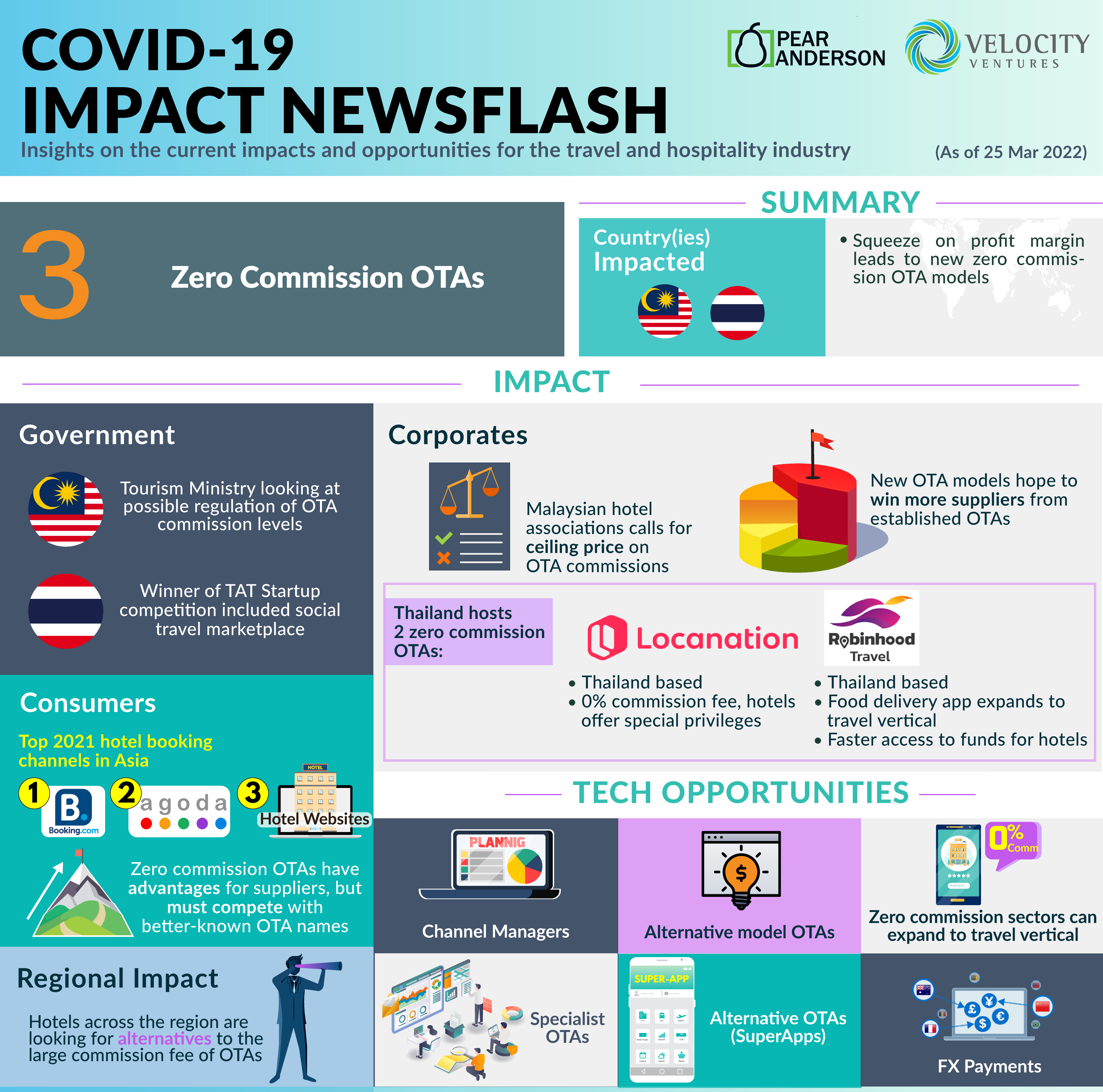

3. Alternative model OTAs

Even prior to the pandemic, hotels and travel suppliers were starting to grow tired of the high commission levels which international Online Travel Agents (OTAs) were demanding. COVID-10 has made that awareness all too acute, when every cent counts, and new zero commission models have started to be tested in Thailand. These have clear benefits for the suppliers – but whether the new platforms will also win market share from customers is also a valid concern.

4. More destinations launching and investing in AR/ VR

Once seen as expensive and not necessary, AR and VR technologies are starting to be used by more destinations and attractions in the region as both an avenue for sales, e.g. charging customers for AR/ VR experiences, as well as enhancing a destination’s marketing tools. Whilst it has far from widespread adoption in Southeast Asia right now, we see the Philippines and Singapore starting to take the lead in practical implementation of these technologies.

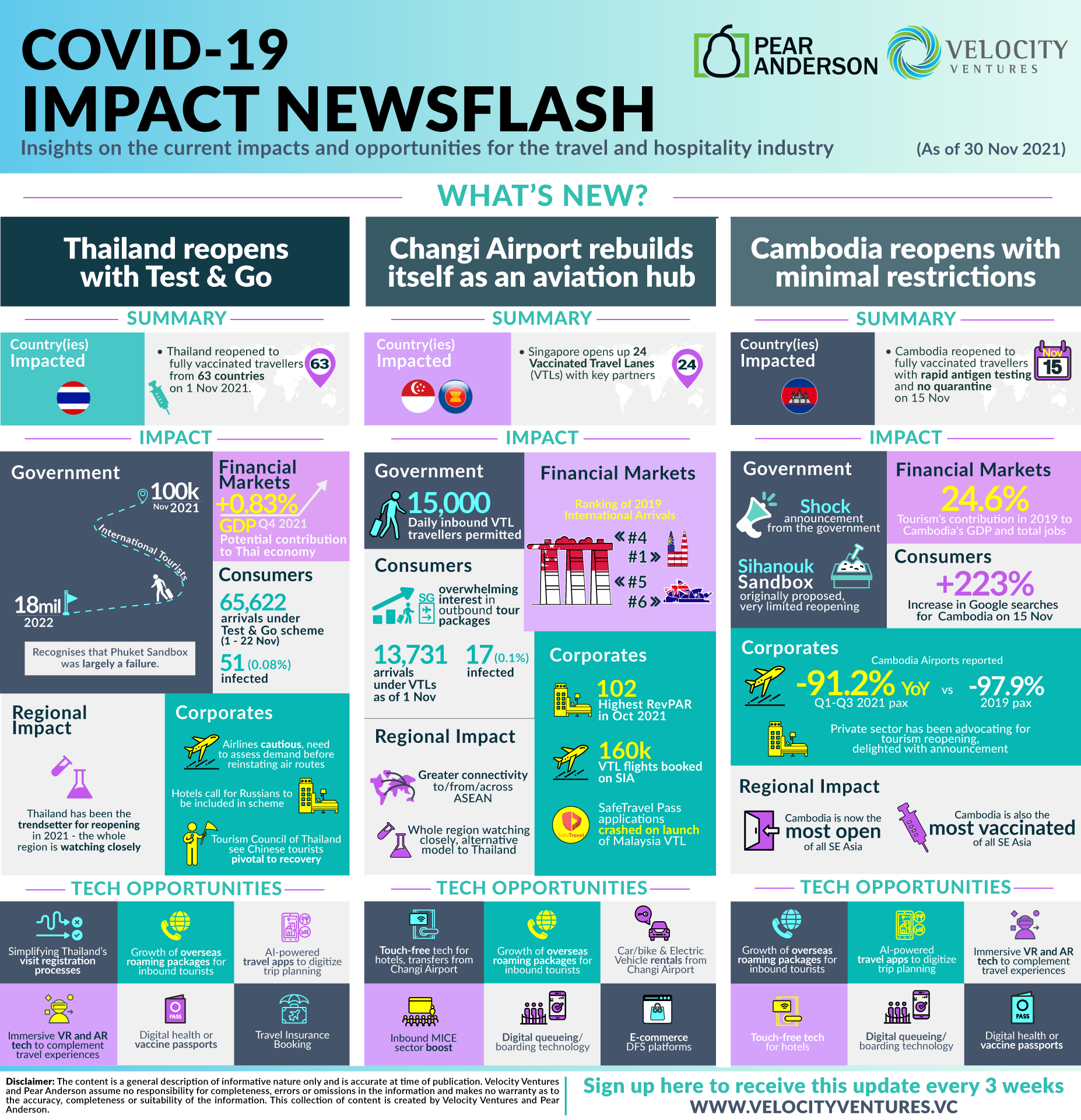

Covid-19 Impact Newsflash – 16 Feb 2022

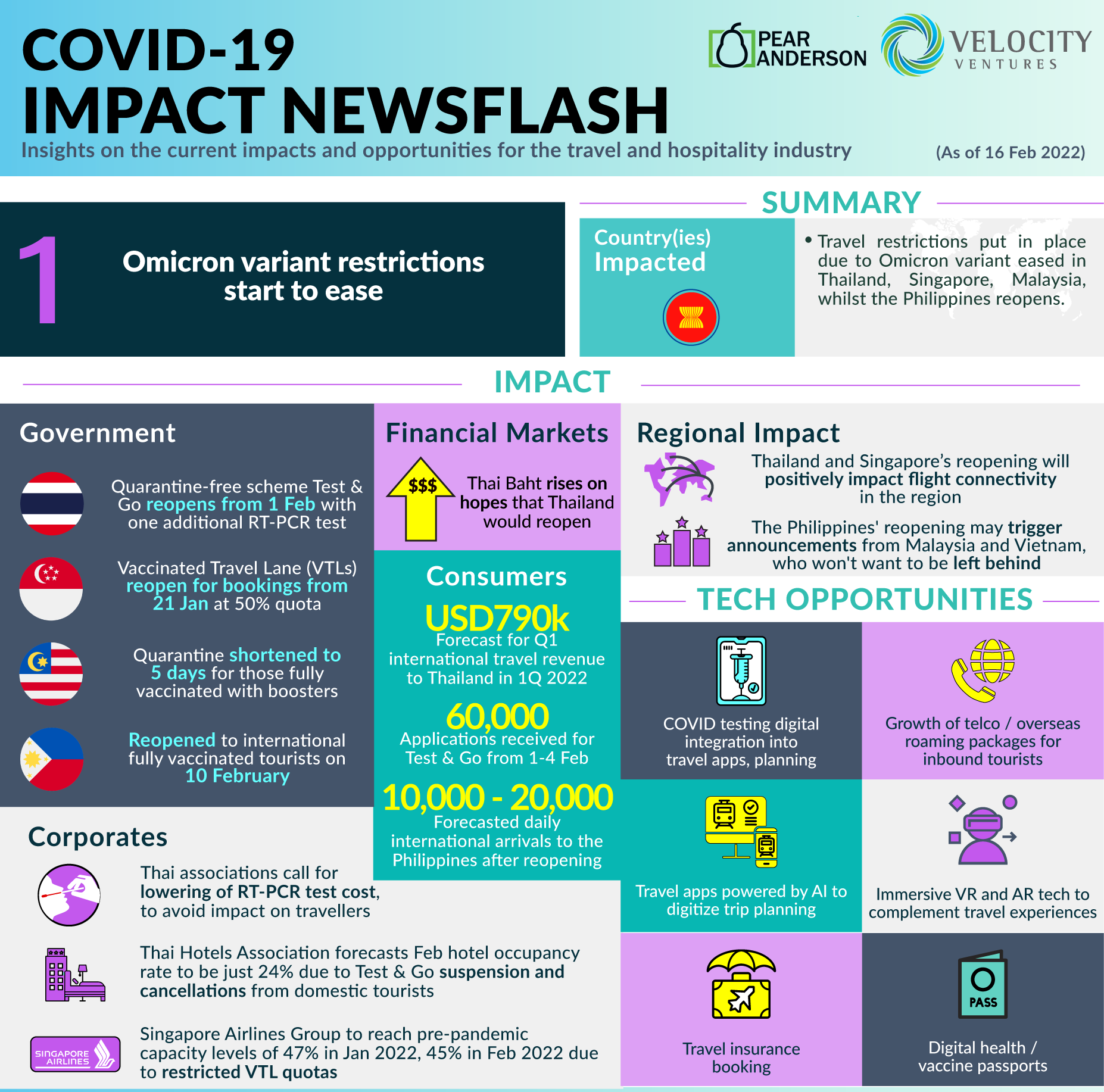

1. Omicron int’l travel restrictions start to be lifted across region

2. Airlines tap into e-commerce

AirAsia arguably started the trend of airlines getting into the e-commerce space, with the AirAsia Super App, and we have seen full-service carriers (FSCs) across Southeast Asia launch their own forays into this space, as a means to supplement their air passenger revenue.

The latest launch is Vietnam Airlines’ VNAMALL and VNAMAZING, one platform focused on travel products, the other an e-commerce play, maximising the airlines’ logistics arm. We are likely to see more of these plays in 2022 from FSCs and LCCs across the region, particularly if existing platforms are successful in generating revenue.

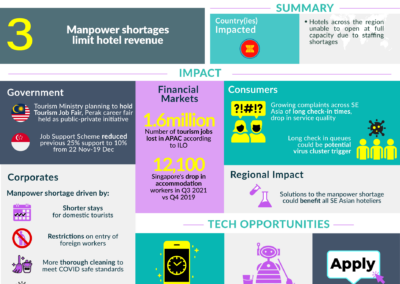

3. Manpower shortages limit hotel revenue

Hoteliers across the region are now facing a dilemma – although consumer demand may be increasing from domestic (and, depending on the country, international) travellers, hotels are unable to reopen at full capacity to take advantage of this demand due to manpower shortages.

The key reasons for this manpower shortage is a lack of interest to enter the tourism industry, restrictions on new foreign workers to be able to enter the country itself, more intensive cleaning procedures, shorter room turnarounds for stays and fluctuating domestic demand are the key ones.

Hotels need support from governments to enable access to more labour, as well as smart technology solutions to be able to resolve these issues and avoid growing complaints from guests over service levels.

Covid-19 Impact Newsflash – 28 Dec 2021

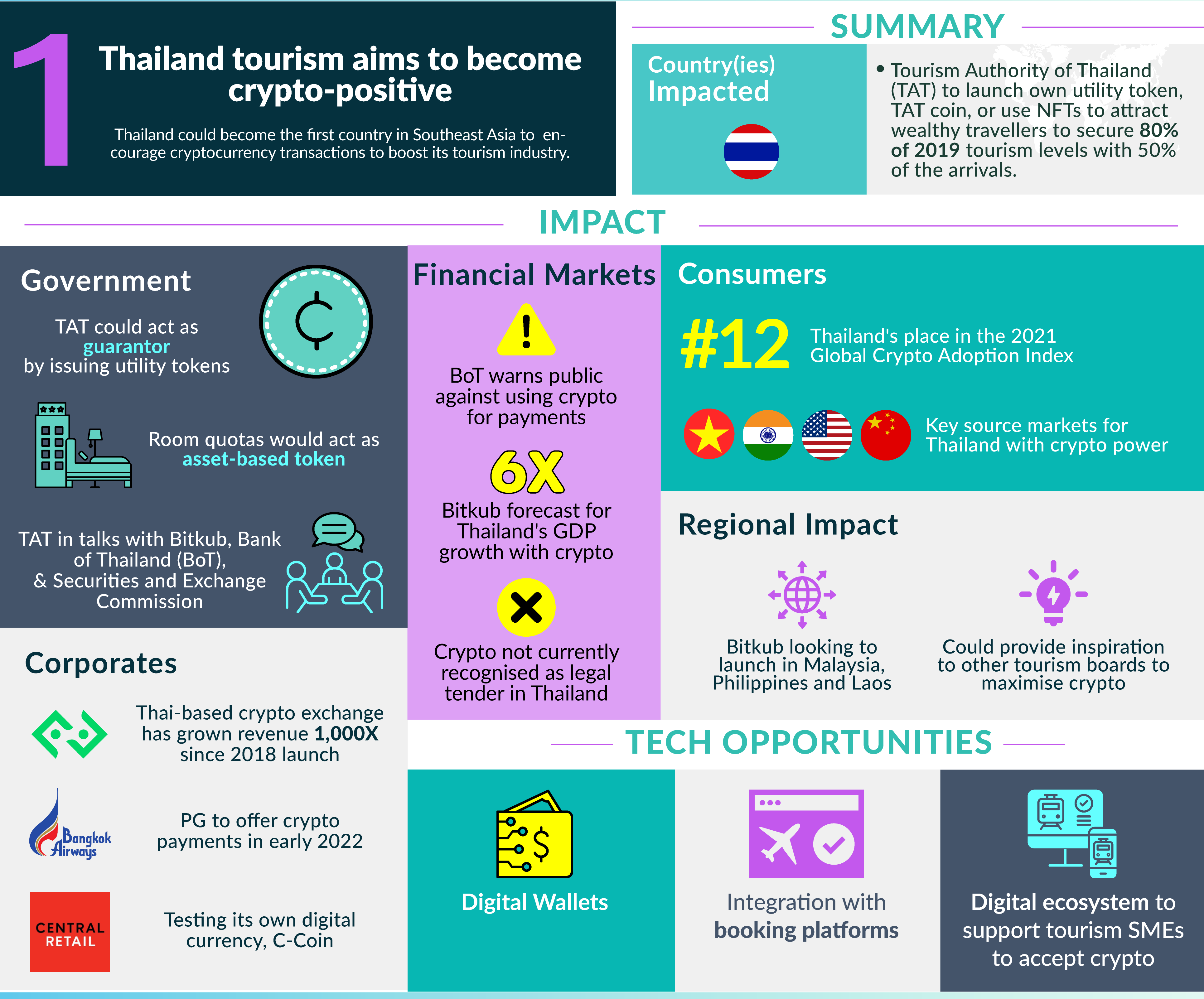

> Thailand tourism aims to become crypto-positive

A development which has captured media headlines in December is the possible play by the Tourism Authority of Thailand to develop its own utility token, “TAT Coin”, or to use NFTs to position Thailand as a “crypto-positive society”. Its logic is that the only way in which Thailand can regain 80% of its 2019 tourism revenue but with only 50% of the arrivals is through attracting high spending tourists – and they believe that cryptocurrency holders tick that box.

It faces challenges – the Bank of Thailand has recently warned consumers against using cryptocurrency for payments, due to its high volatility. Nevertheless, it is working on a consultation paper on digital assets, which should be released in January 2022, and could shed some light on whether the TAT’s idea could be feasible.

Bitkub, Thailand’s largest cryptocurrency exchange, will likely play a role in this development, with the TAT already naming them as a potential partner, and it partnering with retail group Central Retail, as well as Bangkok Airways.

> Omicron hits Southeast Asian tourism

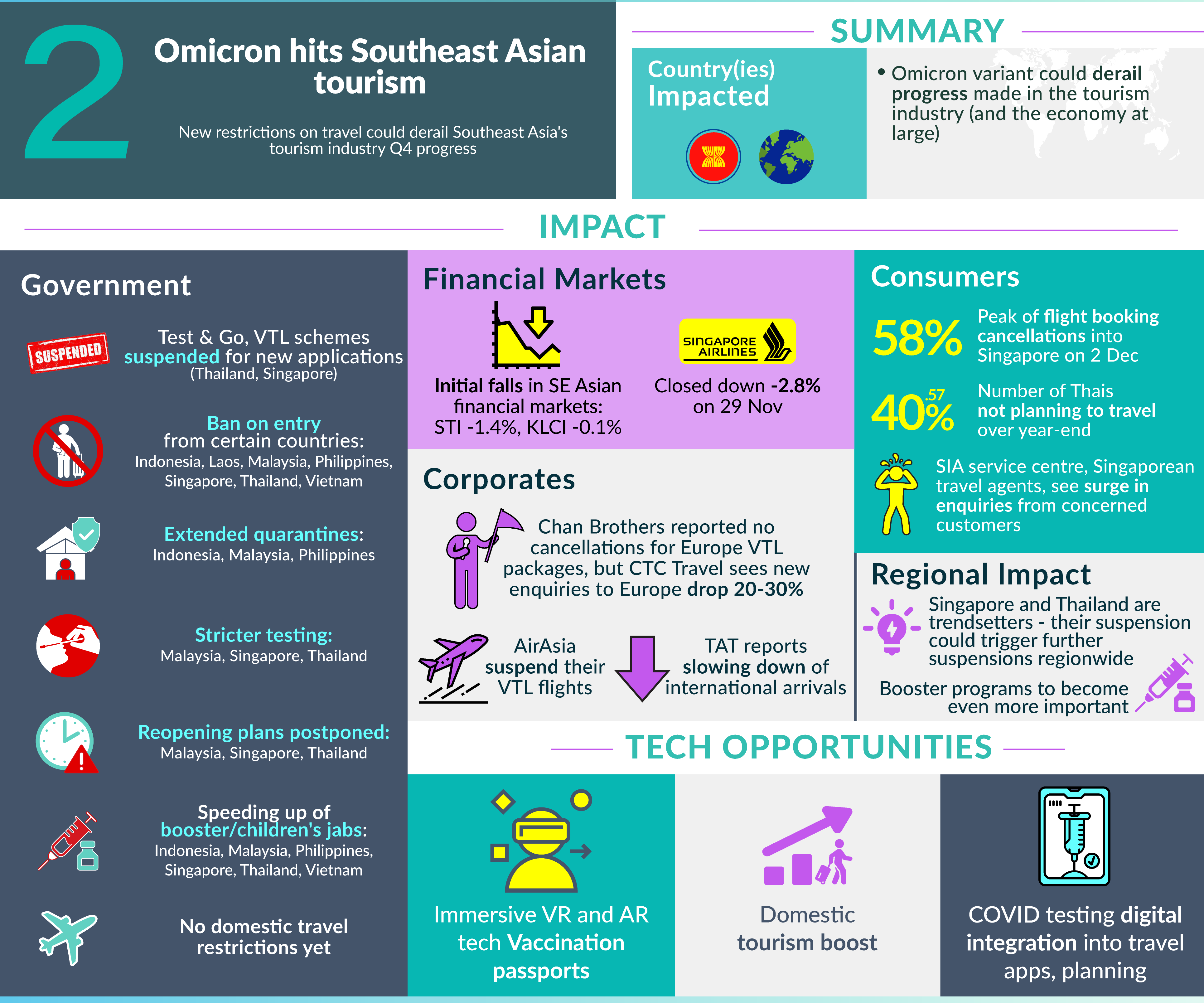

The Omicron variant currently poses the largest danger to Southeast Asia’s tourism industry – and the economy at large in the region. Imported cases have been detected across the majority of the region, and locally transmitted cases are starting to be reported, too.

Thailand and Singapore have taken the strictest measures for inbound tourism so far, both choosing to suspend new applications for the Test & Go scheme and the Vaccinated Travel Lanes (VTLs) respectively. The implications of these actions could have far-reaching ramifications for regional governments’ confidence to reopen international borders, given the fact that they are seen as leaders in reopening schemes.

Other measures governments have taken include banning travellers from countries where the variant has been detected, increasing quarantine, implementing stricter testing and speeding up booster shots and the vaccination of children. No domestic travel restrictions have been imposed yet, but certainly they could be on the cards.

> Medical tourism comes into focus

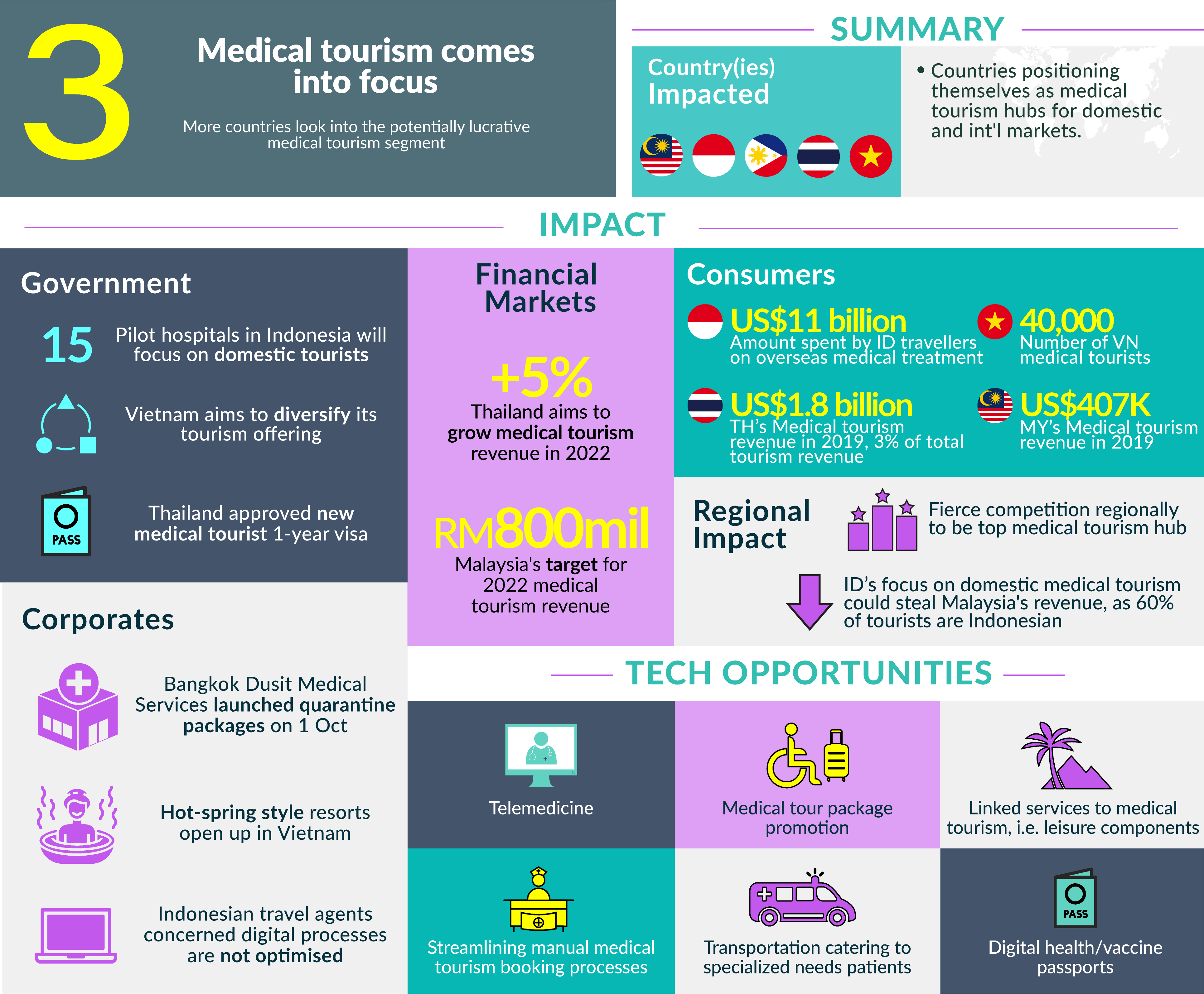

Medical tourism has always been a core part of Thailand and Malaysia’s international tourist strategy, and now other countries in the region are waking up to its potential.

Indonesia in potential has much to gain from promoting medical tourism to its domestic market – pre-pandemic, it’s estimated that Indonesians spent $11 billion USD on overseas medical treatments, and are one of the key source markets for Malaysia. Now, Indonesia wants to develop 15 pilot hospitals throughout the country, offering common medical treatments. Tourism stakeholders welcome the move, although they question whether Indonesian hospitals’ digital processes are sophisticated enough to cater for the market.

Should Indonesia, the Philippines and Vietnam all jump on the medical tourism bandwagon, there could be fierce competition in the region to attract medical tourists.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

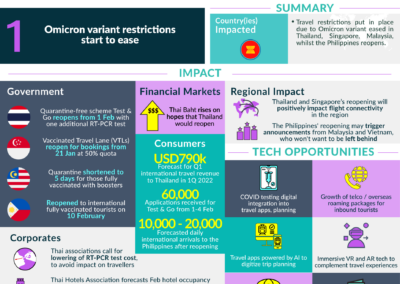

Covid-19 Impact Newsflash – 30 Nov 2021

Read on for a detailed summary of each of the event:

> Thailand’s Reopening

Thailand’s launch on 1st November of its Test and Go scheme, giving quarantine-free access to fully vaccinated travellers from 63 countries, was significant – it built on the limited reopening success it had already had through the Phuket Sandbox, but with less cumbersome entry restrictions. With most of Southeast Asia looking at the Sandbox as a viable way of reopening, Test and Go has positioned Thailand as a leader yet again.

The government and Thailand Authority of Tourism (TAT) have high hopes for the reopening scheme, aiming for 100,000 international travellers in November 2021, and an overall target of 18 million by the end of 2022. The University of the Thai Chamber of Commerce sees a boost to the Thai GDP overall in 2021 of 0.83%.

Whilst tourism stakeholders have greeted the reopening enthusiastically, they also remain cautious about the high expectations, after being previously disappointed by the Phuket Sandbox. With Chinese tourists playing such a key role in Thailand’s source markets, many stakeholders do not foresee a return to previous levels until Chinese travellers return.

Encouragingly, the number of infected travellers arriving has been very small – 0.08%, a positive development which should engender confidence in reopening with less restrictions not only for the Thai government and people, but for Southeast Asian countries in general.

> Singapore’s Reopening

Singapore has approached its handling of the pandemic in a “calibrated” manner, and the Vaccinated Travel Lanes (VTLs) scheme has been an extension of this when it comes to the reopening of international borders.

Initially announcing VTLs with Germany and Brunei, it has now expanded the scheme to 24 countries – not all of these VTLs are reciprocal, but the countries where they are reciprocated have seen an enormous interest in outbound travel from Singaporeans.

There has been a limited impact on inbound tourism in Singapore so far, due to the cap on arrivals at Changi Airport, now increased to 15,000 per day. However, Singapore Airlines has reported selling 160,000 tickets so far on VTL flights, and has seen a significant boost to its passenger carriage.

Singapore’s slow-but-steady approach is providing an alternative reopening approach to that of Thailand – and other Southeast Asian countries have already shifted their rhetoric from “sandboxes” to “VTLs”, suggesting that this cautious approach could gain more traction in the region.

> Cambodia’s Reopening

Cambodia’s reopening to fully vaccinated travellers from all destinations from the 15 November came as a surprise announcement, even to the travel trade in the country. The government had earlier proposed the Sihanouk Sandbox, which was a very limited reopening of certain areas of the country, and had not been met favourably by tourism stakeholders.

Cambodia is the most vaccinated country in Southeast Asia, and now the most open, requiring simply an antigen test upon arrival, and no cumbersome travel pass applications, like Singapore and Thailand.

The reopening of Cambodia’s borders will have a much smaller impact on its regional neighbours in economic terms. However, by choosing the most open approach to reopening, it will spark fierce competition amongst the region to attract international tourists, and, if virus transmission remains low, it could well inspire other countries with confidence to adopt a more open approach.

If you are the founder of a Hospitality & Travel startup in Southeast Asia, get in touch with us.